CVS SWOT Analysis

SWOT analysis of CVS 2022 by EdrawMax is a strategic planning tool that can be used by CVS Health managers to do a situational analysis of the organization.

1. Lead-in

SWOT Analysis analyzes a company based on the most significant four aspects, like the probable strengths that may bring the company a successful business. Its weaknesses might stop the company from reaching great heights, opportunities that can give them a boost for its success, and threats that can be a massive obstacle for the company. SWOT Analysis plays a significant role in helping the managing heads of the company to understand the position of the company in the market and how, with that, they make decisions to improve the company situation further, and the company can reach much more heights of success than before.

This article talks in detail about CVS SWOT Analysis, where these four sectors are looked into concerning the company. They own CVS Pharmacy. It is a retail pharmacy chain that they acquired with Aetna. The SWOT Analysis for CVS ensures that the company does better in the future. In this SWOT analysis guide, we will create a SWOT analysis diagram using the free templates, symbols, and customization options offered by EdrawMax Online. As a registered EdrawMax user, you get the feasibility of downloading and customizing such SWOT analysis templates in just a couple of steps.

2. About CVS

2.1 Introduction of CVS

CVS Healthcare is an American company with a great hold on the US market that started its operation in 1963. It is one of the significant players in the healthcare management industry. A detailed overview of the company is here below.

2.2 Overview of CVS

| Name | CVS Health Corporation |

| Founded | 1963 |

| Industries served: | Healthcare Management, Health insurance, Pharmacy |

| Geographical areas served: | United States |

| Headquarters: | 1 CVS Drive, Woonsocket, Rhode Island, U.S. |

| Current CEO: | Karen S. Lynch |

| Revenue (US$): | US$ 292.11 billion approximately for the year 2021 |

| Profit (US$): | US$7.91 billion for the year 2021 |

| Employees: | 295,000 as of 2021 |

| Main competitors: | Express Script, Avella Specialty Pharmacy, Rite Aid and Walgreens. |

2.3 History of CVS

| 1963 | Founded |

| 1985 | CVS reaches $1 billion in annual sales. |

| 1987 | Stanley Goldstein takes over as chairman and CEO of Melville Corporation. |

| 1996 | Became a stand-alone company. |

| 2000 | CVS Corporation acquires Stadtlander pharmacy; Entered the Chicago market. |

| 2001 | CVS/pharmacy introduces the ExtraCare Card. |

| 2003 | Caremark Rx and AdvancePCS announce strategic combination. |

| 2007 | CVS Corporation and Caremark Rx, Inc. complete their transformative merger. |

| 2012 | CVS Caremark announces that it exceeded $100 billion. |

| 2014 | CVS Caremark removes all cigarettes and tobacco products from its CVS/pharmacy stores . |

| 2016 | CVS Health announces Be The First. |

| 2020 | Announced change in the board of directors. |

| 2021 | CVS Health was ranked 4th on the Fortune 500 list and 7th on the Fortune Global 500 list. |

| 2021 | Announced closing of 900 stores. |

| 2021 | Was accused of being part of the opioid crisis along with Walmart and Walgreens. |

3. SWOT Analysis of CVS

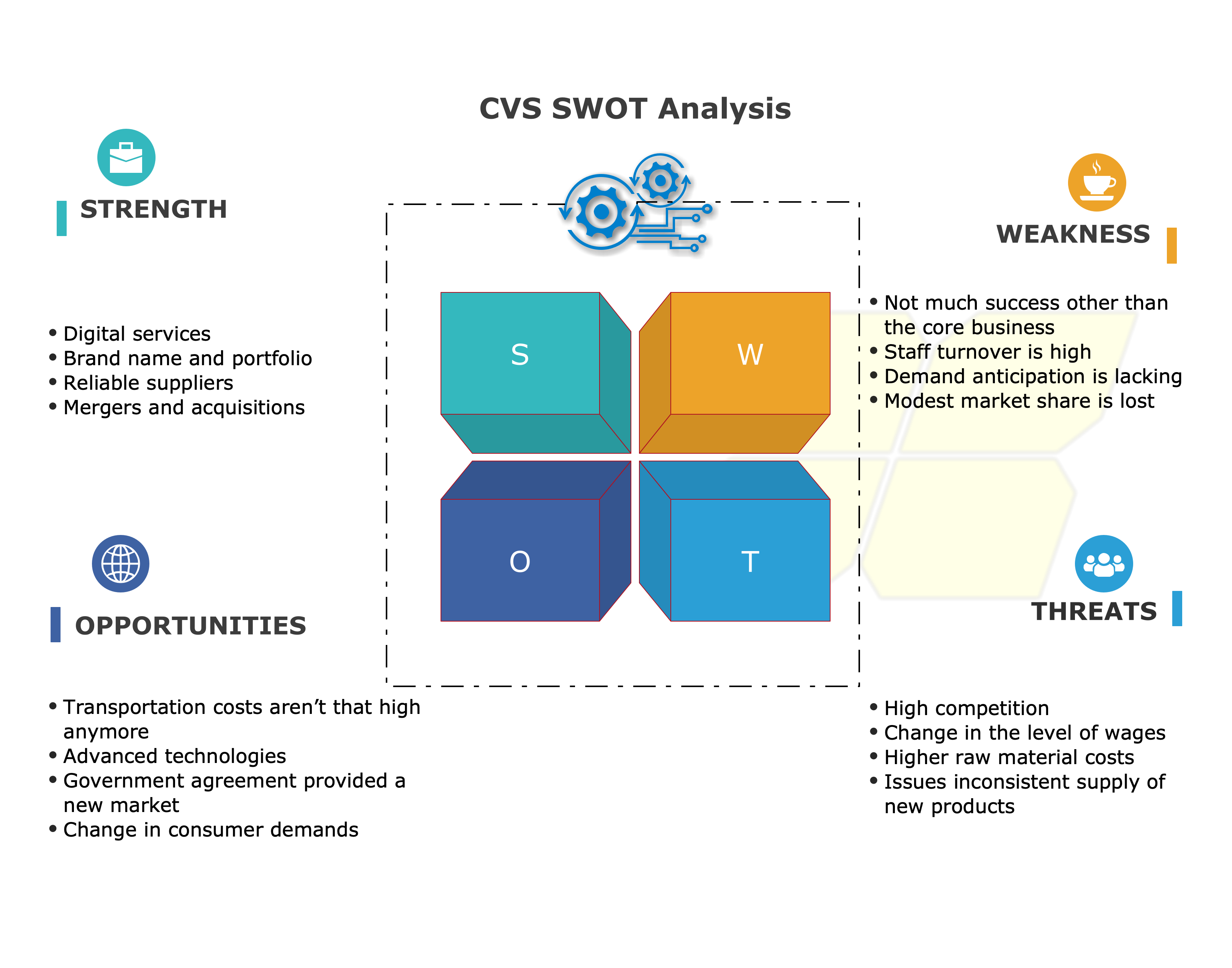

Strengths

- Digital services: When it comes to providing digital healthcare services, CVS is considered one of the leading providers of such services. They give healthcare facilities like one-on-one consultations online with doctors according to the patient's requirement. Anybody can use the CVS mobile app to get medicines and any other CVS healthcare products and services anywhere at any time.

- Brand name and portfolio:Brand name and portfolio for any business is one of the most important and reliable sources, especially for its customers. CVS has successfully created a portfolio that ensures that they do not face any problems when they are on the verge of expanding the business with a new product.

- Reliable suppliers: The company has several suppliers that they rely upon, which help the company get raw materials without facing any supply-related problems.

- Mergers and acquisitions: Mergers and acquisitions are always the best way to strengthen a business or a company, and CVS follows the same path. They have had a lot of mergers and acquisitions that have helped them to get success and reach a position that is of great value.

Weaknesses

- Not much success other than the core business: Sometimes, we see famous and successful businesses and companies try to branch out in different sectors closely related to their primary business. Sometimes these insignificant yet related businesses can become a big deal for a company, but that is not something that CVS can be proud of because they have no other business other than the core and central business.

- Staff turnover is high: CVS health has a much higher staff turnover than any other healthcare system when it comes to competition with its competitors. They should spend much more money to train their staff when compared to its competitors.

- Demand anticipation is lacking: When trying to have a successful business, it is mandatory to have a vision concerning future consumer demand. CVS massively lacks the demand anticipation capability, which causes them to lose its chances to sell more products. It also leads to most of their products being in their in-house inventory and channel rather than reaching their customers.

- Modest market share is lost: Due to several competitors and CVS' incapability to figure out public demand, their market share has reduced remarkably. To get it back, they will have to appoint ground-level staff who will bring back direct feedback to increase their capability of producing in-demand products in the market.

Opportunities

- Transportation costs aren't that high anymore: As the shipping cost has reduced, it has provided CVS healthcare with an option to do well. They can either increase their profit because of the lower production cost. Or they can provide their products at lower prices to increase their market share.

- Advanced technologies: With the advancement of technology, CVS healthcare can improve its services and, in return, become popular among its customers and non-customers. Advanced technology can also make work easier and can save time by a lot.

- Government agreement provided a new market: As CVS health has decided to adopt the new advanced technological standard, it has also agreed on a government free trade. Thus, exploring a new market to do their business.

- Change in consumer demands: CVS fails to predict public demand. However, it is still possible for them to increase their business because of the constant shift in demand and take advantage of this.

Threats

- High competition: Competition is high in every field and industry, and it is the same in the case of CVS healthcare. The fresh emerging local healthcare service providers are making it hard for CVS to have a good business.

- Change in the level of wages: With the wage increase, the production cost will increase, and it can hamper the revenue earned by CVS healthcare.

- Higher raw material costs: Another way by which there is a massive chance that the production cost of CVS will increase is because of the higher raw material costs, and this will again cause a loss for CVS healthcare.

- Issues inconsistent supply of new products: Due to the lack of production of new products, the hold that CVS has over the consumers might face problems, and it can be a significant threat to the healthy and profitable business that CVS has established so far.

CVS SWOT Analysis Diagram

As you have seen here, the organization's SWOT analysis helps us understand its multiple opportunities and threats and how it can utilize its strengths and overcome its weaknesses. In order to understand the SWOT analysis better, we will create a CVS SWOT analysis diagram using the free templates and components offered by EdrawMax.

4. Free SWOT Analysis Diagram Creator

Now that you have seen how easy it is to understand the SWOT of any company, let us check out some of the cool features of using the free SWOT analysis diagram software.

- In this free SWOT analysis creator, you can create your vector-enabled symbols using a Pen or Pencil tool.

- When it comes to EdrawMax, you do not have to worry about the safety and security of your files. All the files in EdrawMax are highly encrypted.

- EdrawMax is an all-in-one diagramming tool that offers free templates, symbols, diagramming components, online resources, and more.

- This free SWOT analysis creator comes for Windows, macOS, Linux, and web (EdrawMax Online).

- In EdrawMax, you can select the target shape before printing and custom print the chosen shapes.

5. Key Takeaways

The main point discussed here is the CVS SWOT Analysis. The strengths, weaknesses, opportunities, and threats that might affect the business have been looked at in detail to understand the company mechanism better and how to make the company work better in the future. SWOT Analysis of CVS is a big plan to make the company do better in the future.

EdrawMax is one such diagramming tool that offers a wide range of options for creating and sharing business-related diagrams, like SWOT analysis or PESTLE analysis. With the in-built templates and customization options, you do not require any technical expertise. All you need is the basic creativity and the data availability, and this diagramming tool will do the rest! Download this tool today and start making SWOT analysis diagrams for free. You can further check out EdrawMax Online, which offers you several remote functionalities of this diagramming tool, like access to private cloud storage and more.

Reference

-

Business News Daily. 2022. SWOT Analysis: Definition and Examples - businessnewsdaily.com., [online]. Available at: https://www.businessnewsdaily.com/4245-swot-analysis.html (Accessed 4 September 2022).

-

Investopedia. 2022. SWOT Analysis: How To With Table and Example., [online] Available at: https://www.investopedia.com/terms/s/swot.asp (Accessed 4 September 2022).