Wells Fargo SWOT Analysis

1. Background of Wells Fargo

1.1. General Overview of Wells Fargo

|

Company Name |

Wells Fargo & Company |

|

CEO |

Charles Scharf |

|

Company Type |

Financial Service |

|

Year Founded |

1852 |

|

Annual Revenue |

The U.S $85.063 billion (2019) |

|

Founders |

Henry Wells, William Fargo |

|

Headquarters |

San Francisco, California (Corporate) Manhattan (Operational) |

1.2. Introduction to Wells Fargo

For the Wells Fargo SWOT analysis, it is crucial to know about its past and future planning. Wells Fargo & Company is a multinational financial services company in America and one of the most revered global financial institutions. It is counted as the fourth top bank in the U.S.A by total assets. It is in number 30th position by total revenue on the 2020 Fortune 500 rankings. It is a merger between Minneapolis-based Norwest Corporation and San Francisco-based Wells Fargo & Company.

The company delineates Wholesale banking, Community banking, retail, commercial, corporate banking, and Wealth, brokerage, and retirement.

1.3. Development Timeline of Wells Fargo

Here is a timeline that showcases the change for 200 years and how Wells Fargo has played a catalyst in the banking revolution of the U.S.A.

|

1781 |

The Bank of North America (now Wells Fargo) funded the revolution |

|

1790 |

Foiling counterfeiters |

|

1852 |

Introducing Wells Fargo |

|

1855-61 |

Earning trust, achieving the impossible |

|

1865-75 |

Supporting reconstruction, bridging gaps, guarding the gold |

|

1980-2000 |

Open all day phone lines, the first bank to introduce online banking |

|

2012 |

Supporting sustainable home ownership |

|

2014 |

Nurturing start-ups |

|

2017 |

Attempt to make banking easier |

2. SWOT Analysis of Wells Fargo

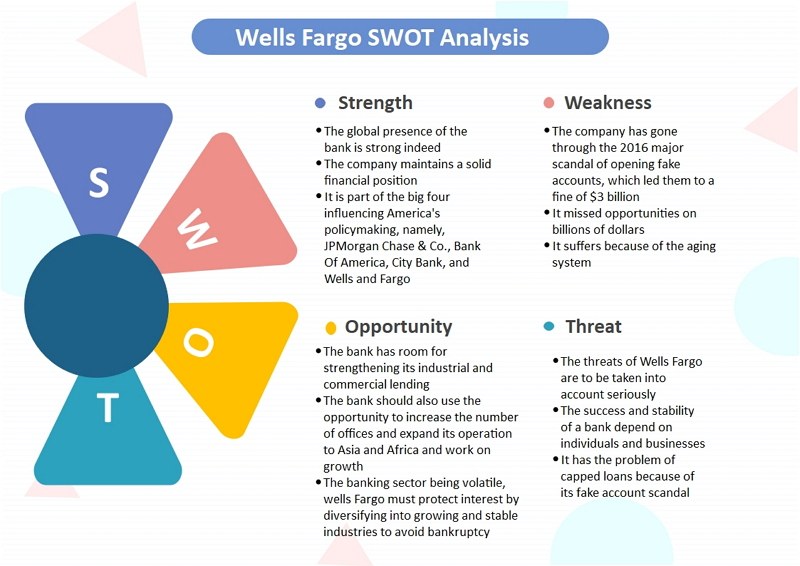

The Wells Fargo SWOT analysis can find out the strategies that can help the company to strengthen its position and maximize revenue. It identifies the effects of competition and weaknesses as per the culture and organizational structure. A company can constantly develop further by assessing itself. At the same time, the company can look for business diversification to earn long-term stability in the market.

2.1. SWOT Analysis of Wells Fargo in Detail

Strength:

Analyzing the strength of any company is a very significant part of their SWOT analysis. The company must be well aware of its strengths as those features have helped them earn its name in the market. The company must keep in mind that they must not neglect their strengths when working on their weaknesses and new opportunities. Like most other brands, The Wells Fargo Market also has some strengths:

- The global presence of the bank is strong indeed. It has access to a wide variety of potential customers from America to Africa, from Europe to the Middle East and Asia;

- The company maintains a solid financial position;

- It is part of the big four influencing America's policymaking, namely, JPMorgan Chase & Co., Bank Of America, City Bank, and Wells and Fargo;

- The brand value is higher for this company; it offers various services like banking, insurance, loan, online banking, merchant service, investment;

- People count it as one of the outstanding and high-performing banks for its exemplary performance.

Weakness:

For any company, it is pretty common to have some weaknesses. The companies need to find strategies that can remove those weaknesses. When a company is in a competitive market, any weakness can impact its growth against its competitors. The company can plan some long-term plans to change those weaknesses into their strengths. Wells Fargo also has some weaknesses. For example:

- The company has gone through the 2016 major scandal of opening fake accounts, which led them to a fine of $3 billion;

- It missed opportunities on billions of dollars;

- It suffers because of the aging system. It has some negative publicity regarding the exploitation of relief aid post-crisis;

- The high operation cost has compelled the company to undermine long-term sustainability and profitability.

Opportunities:

A company must consider the opportunities that they can get to survive the high market competition. They must set their policies as per those opportunities to ensure their growth in the future. They should also consider the condition of the market while working on their opportunities. Here are some opportunities for Wells Fargo:

- The bank has room for strengthening its industrial and commercial lending. It has lost its potential to the other competitors in the recent past;

- The bank should also use the opportunity to increase the number of offices and expand its operation to Asia and Africa and work on growth;

- The banking sector being volatile, wells Fargo must protect interest by diversifying into growing and stable industries to avoid bankruptcy;

- Wells Fargo has successfully dominated and captured the major cities globally. Now it is time to focus on smaller towns and provide their banking services there.

Threats:

All the companies that survive in a competitive market must have some threats that can stop their growth. Other competent opponents' market conditions change of taste of the customers can be prevalent threats. Similarly, a famous brand like WWells Fargo also has some threats:

- The threats of Wells Fargo are to be taken into account seriously. The global recession has destroyed and devastated the economy. It may also affect the company adversely as mortgages and customers default on their loans;

- Once lost, the public trust is difficult to regain. Due to the scandals and allegations, it may lose customers and billions of dollars in a deposit;

- The success and stability of a bank depend on individuals and businesses. The global pandemic has dropped its profit by 89%;

- It has the problem of capped loans because of its fake account scandal. The bank could not take part in the small business relief program and PPP by the government;

- The loss of its market share to the other competitors is a serious threat indeed.

3. Key Takeaways

The Wells Fargo SWOT analysis points out the fact that the company has numerous scopes to perform better. Undoubtedly, the company is one of the most revered names in the financial industry, but Wells Fargo can maintain its success in the financial sector by adopting a few measures.

- To regain its lost value, the company must build transparency, accountability, market trust, concentrate on future actions using the opportunities and create awareness;

- It can work harder to cope up with the competitors.

Use EdrawMax Online to create a SWOT analysis diagram, or create any other diagram with ease! There are massive SWOT templates and symbols to choose from, and creating a SWOT analysis diagram could be really simple. Also, you can find substantial SWOT templates in our template community to have a quick start.